Mining Interests and Investment Opportunities: 2024

Overview

This report outlines key opportunities in U.S. mining, including investment in established companies, exploration of new mineral production, and starting small mining businesses.

Investment-Grade Mining Operations

Top Precious Metals Mining Companies

Investors looking to diversify their gold holdings through stock investments should consider the following U.S.-based or U.S.-operating mining companies. These companies are leaders in gold, silver, and copper mining, offering a range of investment opportunities:

- Newmont Corporation (NYSE: NEM)

• Headquarters: Denver, Colorado

• Overview: Newmont is the world’s largest gold producer, with active mines in Nevada, Colorado, and other regions. It also has a diverse portfolio of copper, silver, lead, and zinc mining projects.

• Investment Appeal: Stable production, strong balance sheet, and steady dividend payouts make Newmont an attractive option for investors seeking exposure to gold. - Barrick Gold Corporation (NYSE: GOLD)

• Headquarters: Toronto, Ontario, with significant U.S. operations in Nevada (part of the Nevada Gold Mines joint venture with Newmont).

• Overview: Barrick is a top-tier gold miner, focusing on efficient, large-scale gold production. The Nevada mines are some of the most profitable gold mining operations in the world.

• Investment Appeal: Barrick offers solid returns for investors with its focus on gold production and operational efficiency. - Freeport-McMoRan (NYSE: FCX)

• Headquarters: Phoenix, Arizona

• Overview: While primarily a copper producer, Freeport-McMoRan also extracts significant quantities of gold from its mining operations. Its Grasberg mine in Indonesia is one of the largest gold and copper mines globally.

• Investment Appeal: Exposure to both copper and gold makes Freeport-McMoRan a good option for investors looking to benefit from the increasing demand for both metals.

Starting a Mining Business: Small Mining Ventures

For those looking to enter the mining industry through small-scale operations, opportunities are abundant, particularly in the Western U.S. where there is still significant gold, silver, and other minerals waiting to be discovered.

Placer Gold Mining

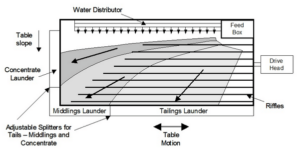

• Regions: Alaska, Nevada, and Arizona offer numerous opportunities for small-scale placer gold mining. These regions are known for gold-rich riverbeds where prospectors can use simple tools like pans and sluices.

• Investment Costs: Starting costs are relatively low, and the venture can be scaled up with more advanced equipment if promising deposits are found.

• Success Stories: Some modern-day prospectors have turned small claims into profitable operations by using advanced metal detection technologies or partnering with larger mining firms for development.

Owning and Developing a Gold Claim

• Locations: Popular areas for staking claims include Nevada, Arizona, and Alaska, with government land often available for claim staking.

• Process: Investors need to secure a mining claim from the Bureau of Land Management (BLM) or state agencies. Claims are often sold or leased to more experienced operators for development.

• Revenue Potential: Even small-scale claims can provide significant returns if good ore grades are found. A successful small mining operation can also attract attention from larger mining companies for potential buyouts or joint ventures.

Path Forward for Investors: Steps to Enter the Mining Industry

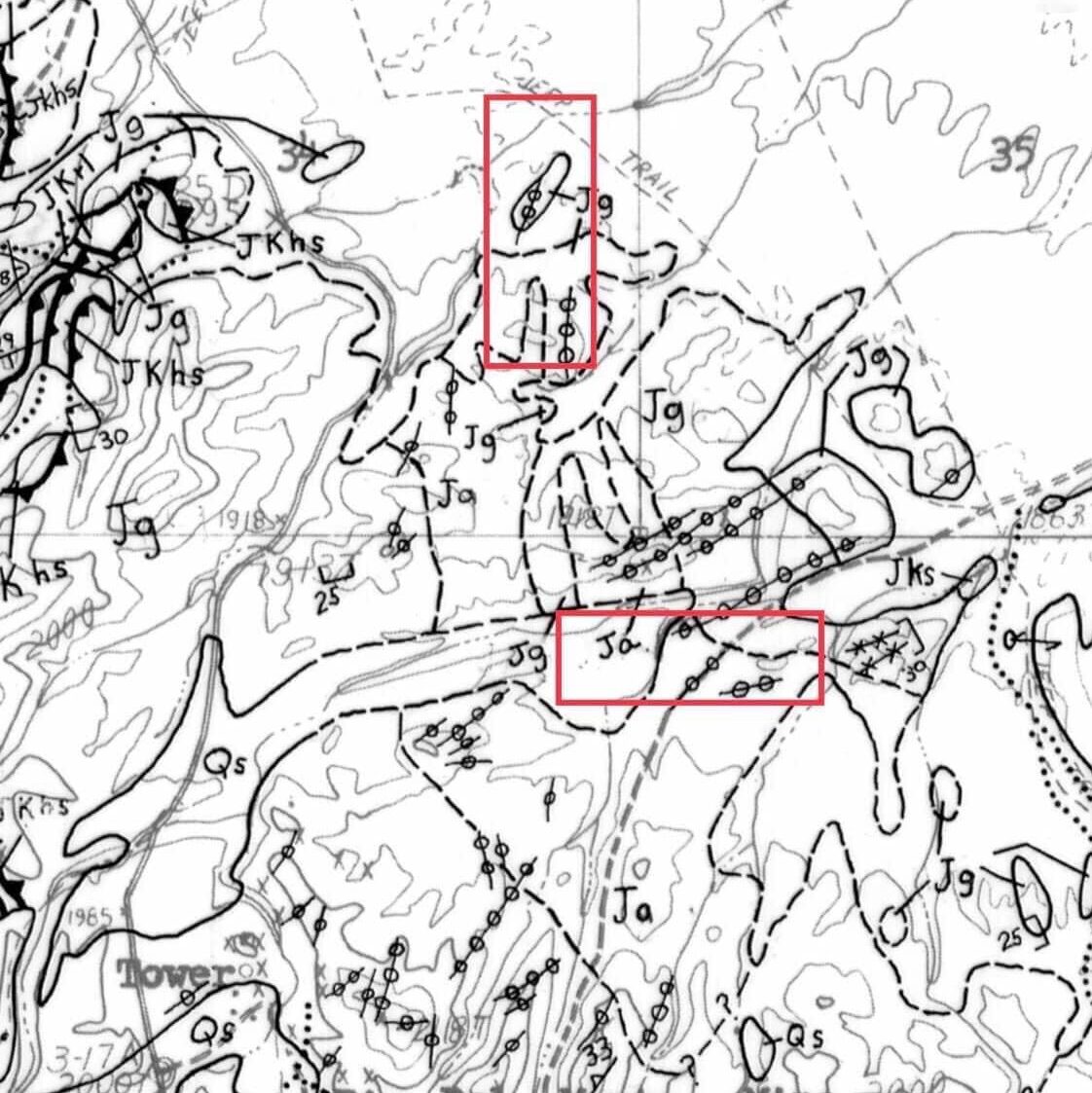

- Research Potential Locations: Start by identifying regions with active mining operations or mineral deposits, such as Nevada for gold or Arizona for copper. Resources like the U.S. Geological Survey (USGS) provide valuable data on mineral deposits.

- Start with Mining Stocks: For those unfamiliar with the mining industry, starting by investing in established mining companies like Newmont or Barrick can be a safe way to gain exposure to gold and mineral production.

- Explore Small-Scale Ventures: If interested in hands-on mining, research areas where small-scale operations are active, such as placer gold mining in Alaska. Claim ownership, especially in mineral-rich areas, offers long-term potential for both operational profits and future sale.

- Consider Critical Minerals: The future of U.S. mining will increasingly be shaped by demand for lithium, rare earth elements, and copper. Diversifying into these minerals can provide long-term growth potential as industries move toward electrification and green technologies.

Conclusion

The U.S. mining industry offers a wide range of opportunities for those seeking to diversify their portfolios beyond physical gold. Mining companies and critical minerals offer significant growth potential. Whether you’re interested in passive investment or direct involvement in a mining operation, the U.S. remains a prime location for mining exploration and investment.