US Gold Mining Interests and Investments

Overview

This report highlights key US Gold Mining Interests and Investments, therefore it covers investments in new mineral exploration, and small business ventures. As a result, investors can better assess the right path forward.

US Gold Mining Interests and Investment-Grade Mining Operations

Top Precious Metals Mining Companies

If you want to diversify your gold holdings, consider U.S.-based mining stocks because these companies lead in gold, silver, and copper mining. Therefore, they present strong investment opportunities.

US Gold Mining Interests and Investments

-

Newmont Corporation (NYSE: NEM)

• Headquarters: Denver, Colorado

• Overview: Newmont leads global gold production with mines in Nevada, Colorado, and beyond. It also manages copper, silver, lead, and zinc projects.

• Investment Appeal: Investors value its stable output, strong finances, and regular dividends because those are real profits. -

Barrick Gold Corporation (NYSE: GOLD)

• Headquarters: Toronto, Ontario, with major U.S. operations in Nevada.

• Overview: Barrick runs large-scale, efficient gold mines. Notably, its Nevada Gold Mines venture with Newmont ranks among the world’s most profitable.

• Investment Appeal: Barrick focuses on efficiency and steady returns, therefore it is attractive to many investors. -

Freeport-McMoRan (NYSE: FCX)

• Headquarters: Phoenix, Arizona

• Overview: While mainly a copper producer, Freeport also extracts gold. Its Grasberg mine in Indonesia ranks among the largest globally.

• Investment Appeal: Investors gain exposure to both copper and gold, supporting growth in green technologies.

Starting a Mining Business: Small Mining Ventures

Entrepreneurs can enter mining through small-scale operations because in the Western U.S. vast reserves of gold and silver remain intact. As a result, these ventures offer solid potential for growth and prosperity.

Placer Gold Mining

• Regions: Alaska, Nevada, and Arizona support small-scale placer mining because these areas feature gold-rich riverbeds where basic tools work well.

• Investment Costs: Starting costs remain low, therefore, successful operations can scale up with modern equipment.

• Success Stories: Some prospectors partner with mining firms to grow small claims into thriving businesses.

Owning and Developing a Gold Claim

• Locations: Popular states for claim-staking include Nevada, Arizona, and Alaska. Much of this land is managed by the U.S. government.

• Process: Investors must file claims with the Bureau of Land Management or state agencies. Many sell or lease their claims to experienced developers.

• Revenue Potential: Even a small claim can produce solid returns because successful sites often attract buyouts from larger companies.

Path Forward for Investors: Steps to Enter the Mining Industry

Do Your US Gold Mining Interests and Investments Research

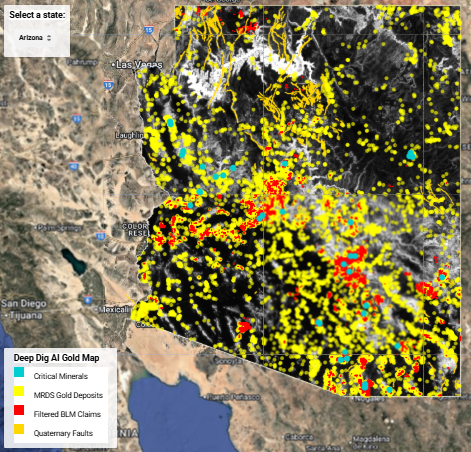

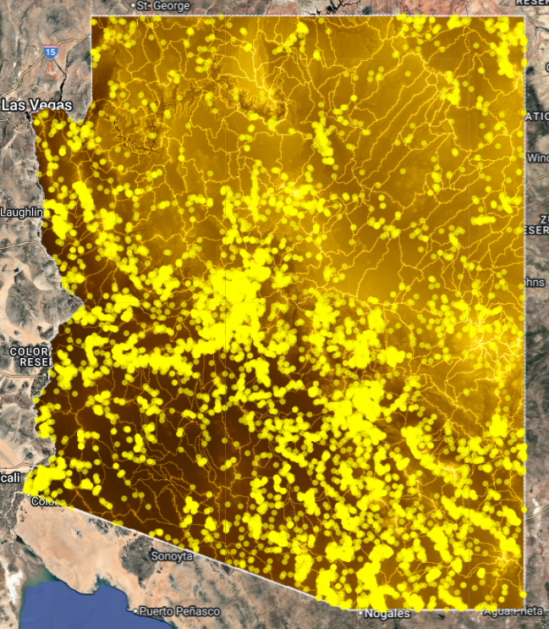

- Research Potential Locations: Explore active regions like Nevada or Arizona and use data from the U.S. Geological Survey (USGS) inside our AI Gold Maps.

- Start with Mining Stocks: New investors can reduce risk by investing in companies like Newmont or Barrick because this method provides exposure without demands.

- Explore Small-Scale Ventures: If you prefer hands-on involvement, research areas with active placer mining because claim ownership can generate profits and future sales.

- Consider Critical Minerals: U.S. mining will increasingly depend on lithium, rare earths, and copper. These materials support electric vehicles and green technology, offering long-term growth.

Conclusion

The U.S. mining sector presents diverse investment options. From passive stock investments to hands-on operations, opportunities abound. Furthermore, rising demand for gold and critical minerals keeps the market attractive because now is the time to explore.

Visit AurumMeum.com to explore in-depth, AI gold mining insights and tools for investors and prospectors like our AI Gold Maps.